The Euro Falls as Political Uncertainty Rises in Europe After Parliamentary Elections

In a surprising turn of events, the euro fell in early trading as political uncertainty in Europe increased following parliamentary elections over the weekend. This news comes as a shock to many, as the currency under-performed its major peers, dropping as much as 0.3% to its weakest in about a month.

On the other hand, the dollar remained steady against major peers, maintaining its position in the market. US equity futures were little changed in early trading, while Asian stock futures fell as traders slashed bets on Federal Reserve easing. However, most major markets are closed on Monday for a holiday.

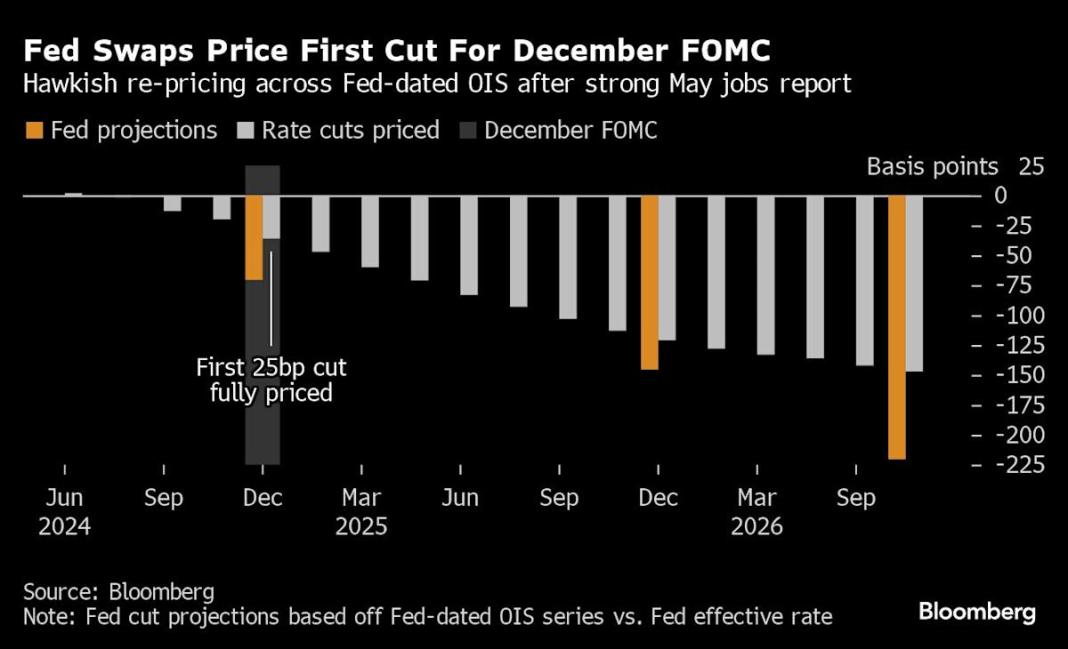

The dollar’s stability comes after it jumped to the highest in over a month following a solid jobs report that spurred a rethink on Fed interest-rate cuts. Treasuries in the US sank on Friday, sending yields up over 10 basis points, with swaps no longer pricing in a Fed reduction before December.

The latest jobs figures highlight a labor market that continues to defy expectations and blunt the impact on the economy from high interest rates and prices. This strength risks keeping inflationary pressures stubborn, which will likely reinforce the Fed’s cautious stance.

Looking ahead, policy meetings by the Federal Reserve and Bank of Japan will take center stage later in the week. Data highlights include Japan’s revised growth figures on Monday and later UK wage numbers, China inflation, and US consumer and producer price figures.

Economists at Citigroup Inc. and JPMorgan Chase & Co. changed their calls after the jobs report, with Citi’s Andrew Hollenhorst now seeing cuts in September, November, and December, and JPMorgan’s Michael Feroli predicting a Fed reduction in November.

The June Fed meeting will be pivotal this year as Chair Jerome Powell may provide the clearest hint yet to the rate-cut timetable. With the Fed widely expected to stay on hold, the focus of the meeting will be the new Summary of Economic Projections.

Overall, the market is in a state of flux as political uncertainty in Europe and the upcoming policy meetings by major central banks keep investors on edge. Stay tuned for more updates as the situation continues to develop.